Fluid Tokens: Revolutionizing Lending, Borrowing, and Trading on Bitcoin’s Native Layer

-

by Dr. Steven Brule

by Dr. Steven Brule

- May 11, 2024

Welcome to the future of decentralized finance on Bitcoin. Fluid Tokens is pioneering an innovative platform that integrates lending, borrowing, and a decentralized exchange (DEX), directly on Bitcoin’s native layer. This blog post will explore the revolutionary features of Fluid Tokens and how it’s set to transform the way we interact with digital assets on Bitcoin.

Permissionless Innovation in Lending and Borrowing

Fluid Tokens is redefining trust and accessibility in digital asset management. Traditional decentralized applications (DApps) often rely on oracles or multi-signature scripts, placing your assets under third-party control. Fluid Tokens eliminates this dependence with its open-source, permissionless script, ensuring full control remains with the asset holder.

Key Features:

- Transaction-Chaining: Fluid Tokens utilizes the deterministic nature of Bitcoin transactions to enable transaction-chaining. This feature allows users to sign transactions that haven’t yet settled on the blockchain, providing uninterrupted access and interaction with assets, even if the frontend interface is offline.

Pooled Lending: A Game-Changer for Bitcoin DeFi

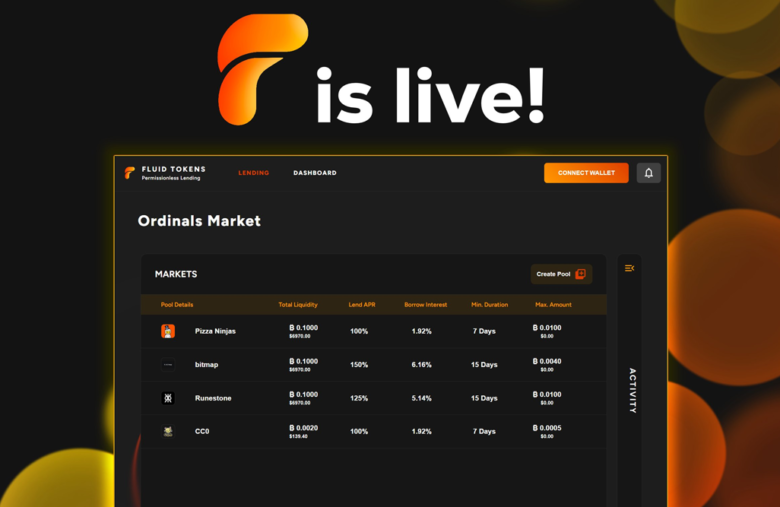

Fluid Tokens introduces pooled lending, a dynamic shift from the traditional one-to-one lending models. This system allows borrowers to access funds from a liquidity pool dedicated to specific ordinal collections, enabling multiple lenders to contribute to the same pool.

Benefits of Pooled Lending:

- Flexibility in Loan Terms: Forget rigid loan structures. Fluid Tokens empowers lenders to set up pools with customizable terms such as duration, annual percentage rate (APR), and maximum loan amounts. Borrowers can shop across these pools to find conditions that best meet their needs.

- Increased Accessibility: Borrowers are no longer restricted to matching individual loan offers. Instead, they can tap into a broader market of funds pooled by multiple lenders.

Broadening the Collateral Spectrum

Not just limited to Ordinals NFTs, Fluid Tokens broadens its horizons by accepting various forms of collateral including BRC-20 tokens and Runes. This inclusivity enables users to leverage a wider range of assets for their financial needs, promoting flexibility and innovation in the use of digital assets.

Efficient and Cost-Effective Airdrops

Fluid Tokens has reimagined the airdrop process through its cost-effective strategy. By consolidating BTC from users into a single transaction, Fluid Tokens dramatically reduces the transaction fees typically associated with airdrops, passing on significant savings to the users.

Runes and Light Pools: Enhancing Trading on Bitcoin

Building on the foundational work of Casey Rodarmor, creator of Ordinal Theory and the Rune protocol, Fluid Tokens enhances the Light Pools concept by introducing features like limit orders, market orders, and Rune/Rune pair trading. This development underscores Fluid Tokens’ commitment to providing a robust trading platform on Bitcoin.

Why Runes?

Runes represent a superior token standard on Bitcoin due to their efficiency and DeFi compatibility. They support multiple transactions in a single action without increasing costs, align perfectly with Bitcoin’s UTXO model, and prevent double spending, making them ideal for decentralized finance applications.

Forward Thinking

Fluid Tokens is not just another platform; it’s a visionary leap towards a decentralized and permissionless financial ecosystem on Bitcoin. By offering innovative solutions for lending, borrowing, and trading, Fluid Tokens is poised to redefine the financial landscape, ensuring users have the tools they need to manage and grow their digital assets securely and efficiently.

Stay tuned to Fluid Tokens as it continues to break new ground, providing transparent, user-driven services that prioritize control, flexibility, and efficiency in Bitcoin’s expanding DeFi sector.

Disclaimer: The above article is for informational purposes only and does not constitute financial advice. The cryptocurrency market is volatile and unpredictable; always conduct your research before investing.