Bitcoin’s Digital Asset Market Revival: Ordinals and Runes Lead the Charge

-

by Dr. Steven Brule

by Dr. Steven Brule

- September 27, 2024

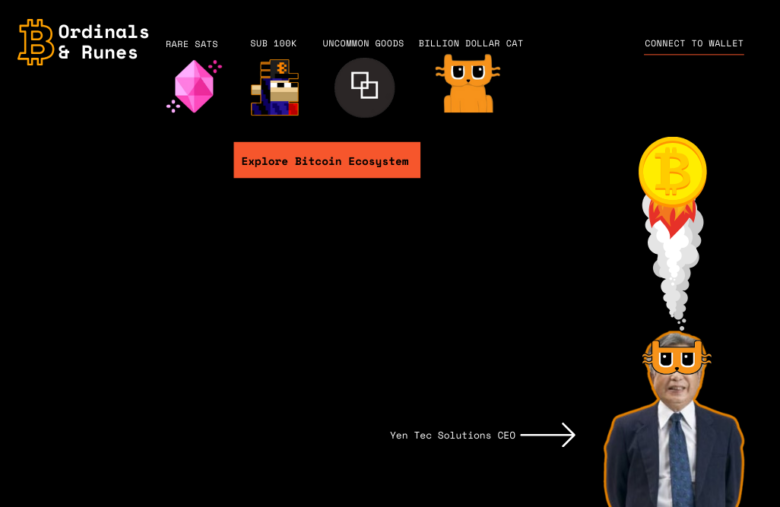

The Bitcoin ecosystem is undergoing a major revival, with Ordinals and the Runes protocol reigniting excitement in the digital assets space. While other blockchains and their associated assets struggle to regain momentum, Bitcoin-based innovations are showing remarkable resilience and growth. Let’s dive into how the resurgence of Ordinals and Runes is reshaping Bitcoin’s digital assets landscape.

Ordinals’ Strong Comeback: Defying Market Trends

After facing a temporary decline, Bitcoin Ordinals are once again commanding attention. This resurgence comes at a time when the broader NFT market, particularly on Ethereum and Solana, is struggling to maintain the growth and hype it once enjoyed. Despite a cooling NFT market, Ordinals collections have displayed impressive performance, even in the face of competition from the rising Runes protocol.

Notably, collections like NodeMonkes have seen their floor prices skyrocket to 0.2 BTC (around $13,000), and other Ordinals collections, such as Quantum Cats and Pizza Ninjas, have posted gains of 10% and 18% respectively. These figures highlight a renewed interest and confidence in Bitcoin-based digital collectibles.

Runes Protocol Dominates but Shares the Spotlight

Earlier in the year, the Runes protocol surged, temporarily overshadowing Ordinals. At its peak in mid-August, Runes accounted for up to 70% of Bitcoin’s transaction volume, signaling strong interest from the community. Runes tokens, such as $DOG (Dog Go To The Moon), $BDC (Billion Dollar Cat), and $Pups (Pups World Peace), are gaining popularity, particularly among meme coin enthusiasts, with expectations of even bigger movements in Q4 of 2024.

Despite the initial excitement, the full potential of Runes has yet to unfold. Early challenges in liquidity and market conditions held back the explosive growth many anticipated. However, with loyal communities backing top Runes tokens, there’s potential for significant movement in the coming months.

The Broader Impact on Bitcoin and Digital Assets

The simultaneous resurgence of Ordinals and the rise of Runes highlight the evolving preferences of digital asset investors. While Ethereum and Solana-based NFT projects like CryptoPunks and Bored Ape Yacht Club have faced stagnation, Bitcoin’s ecosystem has shown remarkable dynamism. This shift reflects a broader change in market sentiment, with investors increasingly drawn to Bitcoin-based assets over those on alternative chains.

According to CoinGecko, the market for Ordinals has grown to a valuation of $759 million since their introduction in early 2023 by Casey Rodarmor. This success, combined with the growing traction of Runes, reinforces Bitcoin’s position as a key player in the digital assets space.

The Future: Bitcoin’s Ecosystem Continues to Evolve with Scaling Solutions

The resurgence of Ordinals and Runes showcases the enduring innovation within the Bitcoin ecosystem. While the NFT space on other blockchains faces challenges, Bitcoin is solidifying its role as a leader in digital collectibles and meme coins. As 2024 progresses, investors should keep an eye on how these protocols further evolve, especially as we approach what could be a pivotal fourth quarter for Runes. Scaling solutions such as Merlin Chain, Fractal Bitcoin & Stacks will assist these layer-one assets by making them much more flexible. Also, the user experience becomes better with faster transactions & on-chain computational functionality that allows for complex dapps such as swaps & DEX. Look out for these Bitcoin side chains as they help grow the ecosystem at a rapid rate.

In conclusion, the relaunch of Bitcoin’s digital assets market—led by the dual revival of Ordinals and Runes—signals a new chapter in the evolution of blockchain-based assets. Bitcoin is proving its dominance once again, not just as the world’s most secure monetary system but also as a thriving hub for innovative digital assets.

Disclaimer: The above article is for informational purposes only and does not constitute financial advice. The cryptocurrency market is volatile and unpredictable; always conduct your research before investing.