Bitcoin Digital Artifacts(NFTs): The Ascending Titan in Digital Asset Trade

-

by Dr. Steven Brule

by Dr. Steven Brule

- November 20, 2023

A New Sheriff in Town

The digital asset space has been abuzz with a historic shift in the NFT market dynamics: Bitcoin, the original cryptocurrency, has for the first time surpassed Ethereum in NFT sales volume over a 30-day period. This monumental achievement reflects the burgeoning potential of Bitcoin Ordinals and the rising interest in BRC20s within the NFT marketplace.

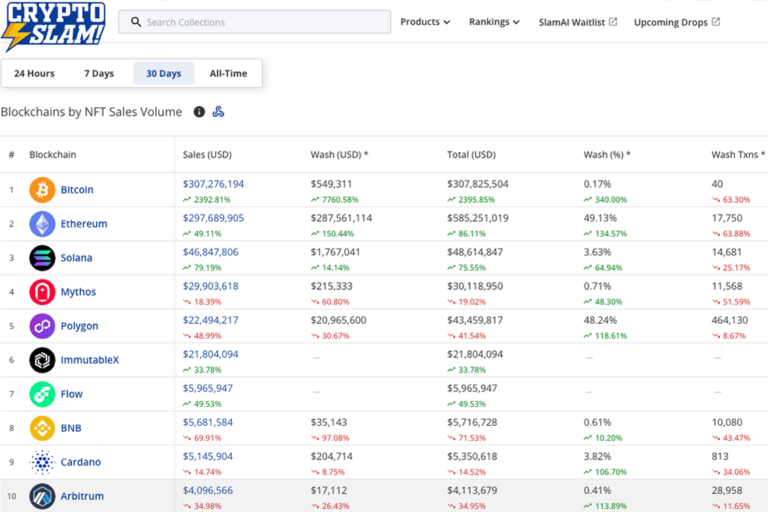

A New Leader in NFT Trade Volume

According to recent data from Crytposlam, Bitcoin has outperformed Ethereum in NFT sales, recording a staggering $306,722,149 in trade volume compared to Ethereum’s $297,665,094 over the past month. This leap forward is particularly noteworthy given that Bitcoin’s foray into layer-one NFT markets began only in early 2023, catalyzed by the advent of Ordinal Theory. This framework, devised by developer Casey Rodarmor, has ignited a substantial movement for Bitcoin layer one assets.

The Ordinal Impact

Ordinal inscriptions have played a pivotal role in this surge, providing a means to inscribe data such as JPEGs onto the smallest unit of bitcoin, satoshis. The enthusiasm around Bitcoin-based NFTs has been fueled further by prominent collections such as Bitcoin Frogs, Ordinal Maxi Biz(OMB), Bitcoin whales, Goosinals, and Bitcoin punks, drawing significant sales and attention to the platform.

Comparative Analysis with Ethereum

An intriguing aspect of Bitcoin’s recent surge is the volume of BRC20 token trading, a new fungible and non-fungible token standard on the Bitcoin blockchain. It’s important to note that Ethereum’s trade volume metrics exclude ERC20 trading, while Bitcoin’s figures currently include BRC20 volume due to the inability of data aggregators to separate the two. Nevertheless, experts speculate that Bitcoin’s NFT volume would still outpace Ethereum’s even without the inclusion of BRC20 trades.

Market Integrity: Wash Trading Considerations

Another distinctive feature of Bitcoin’s NFT marketplace is the apparent minimal presence of wash trading—a manipulative practice that inflates trade volumes artificially. This contrasts with Ethereum’s marketplace, where nearly 50% of the trade volume has been attributed to wash trading in various time frames. The relative absence of such practices on the Bitcoin blockchain lends additional credibility and integrity to its burgeoning NFT ecosystem.

Future Outlook

The rise of Bitcoin in the NFT domain is not just a temporary spike in interest. Ordinals have consistently gained traction among investors and collectors, with Bitcoin’s NFT sales volume witnessing an astonishing 608% increase this week alone. This growth trajectory positions Bitcoin as a significant contender for the top spot in the NFT market, challenging the long-standing dominance of Ethereum and signaling a potential paradigm shift in layer-one asset trading.

Final Words

Bitcoin’s recent dominance in NFT trade volume is a testament to the evolving landscape of digital assets. With Bitcoin Ordinals and BRC20 tokens gaining prominence, the future of NFTs on Bitcoin looks promising. While it remains to be seen whether this trend will continue, one thing is certain: Bitcoin layer one assets have made an indelible mark on the industry, signaling their staying power in the digital art and collectibles space. As the market continues to mature, all eyes will be on how these platforms evolve and how they will shape the future of NFT trading.

For a more detailed dive into the statistics and rankings of NFTs by blockchain, readers can explore CryptoSlam, a reputable on-chain data aggregator that provides real-time insights into the NFT market.

Disclaimer: The above article is for informational purposes only and does not constitute financial advice. The cryptocurrency market is volatile and unpredictable; always conduct your research before investing.