Uncategorized

Donald Trump’s 2024 Victory: A Potential Boon for Bitcoin and Crypto

-

by Dr. Steven Brule

by Dr. Steven Brule

- November 6, 2024

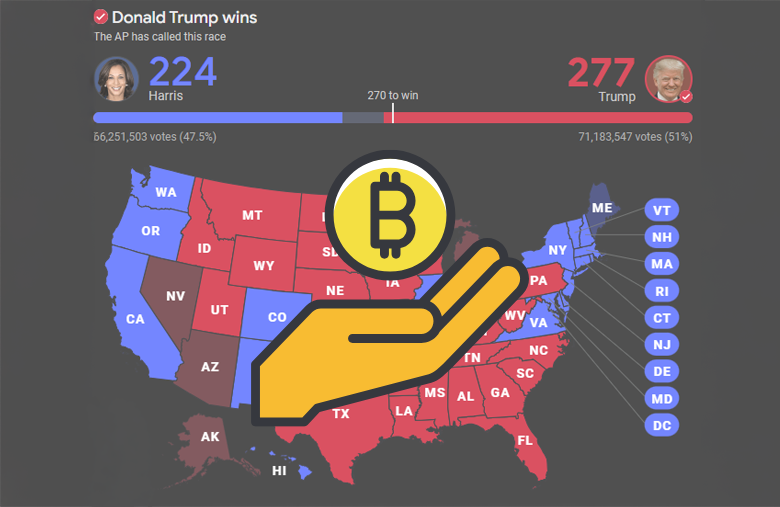

As the dust settles on the 2024 U.S. Presidential election, many eyes in the financial world, especially those in the cryptocurrency sector, are keenly observing the implications of Donald Trump’s victory. While political inclinations vary, the crypto community has reasons to speculate on how this might influence Bitcoin and the broader digital currency landscape.

Trump’s Pro-Crypto Stance

During his campaign, Donald Trump positioned himself as a friend to the crypto industry. Here’s how this could manifest into positive developments:

-

Regulatory Favorability: Trump has promised to create a “strategic national bitcoin stockpile,” suggesting a level of recognition and acceptance of Bitcoin as an asset class. This could lead to more favorable regulatory environments, reducing the regulatory pressure that has been a concern under previous administrations.

-

SEC Chair Change: The indication that SEC Chair Gary Gensler could be replaced is significant. Gensler’s tenure has been marked by a cautious, sometimes restrictive approach towards cryptocurrencies, which has not always sat well with crypto enthusiasts. A change here might usher in an era of clearer, more crypto-friendly regulations.

-

Increased Legitimacy: Trump’s acknowledgment of cryptocurrencies could legitimize them further in the eyes of traditional investors. His previous ventures into NFTs and his vocal support for Bitcoin during the campaign have already signaled his interest in digital assets, which might encourage more institutional adoption.

Market Sentiment and Price Impact

-

Bullish Predictions: Financial analysts have speculated that Bitcoin could see significant price surges post-election under a Trump presidency. Predictions from firms like Bernstein suggest Bitcoin might reach or exceed its previous all-time highs, potentially hitting $80,000 to $90,000 if the market reacts positively to his policies.

-

Election Betting and Crypto: There has been a noted correlation between Trump’s election odds on platforms like Polymarket and Bitcoin’s price movements. This intertwining suggests that market sentiment might be heavily influenced by political outcomes, with Bitcoin acting as a ‘Trump trade’.

Crypto Industry’s Response

-

Industry Investments: The crypto industry has invested heavily in this election, with super PACs and direct donations aiming to sway policy in favor of digital currencies. Trump’s win could be seen as a validation of these efforts, potentially leading to more industry backing for political causes.

-

Innovation and Growth: With less regulatory overhang, innovation within the crypto space might flourish. Startups and established companies might feel more secure investing in and developing new blockchain technologies, knowing that the political climate could be more supportive.

Global Influence

-

U.S. as Crypto Capital: Trump’s vision to make the U.S. the “crypto capital of the planet” could influence global crypto policies. If the U.S. leads with a progressive stance, other nations might follow, fostering a more global acceptance of cryptocurrencies.

-

International Relations: Trump’s foreign policy could also impact how international markets view and interact with cryptocurrencies, potentially affecting global trade and investment flows related to crypto assets.

Conclusion

While the future remains uncertain and subject to numerous variables, Donald Trump’s win in the 2024 election presents several scenarios where Bitcoin and the broader crypto market could thrive. Lower regulatory barriers, a change in SEC leadership, and direct policy support could propel Bitcoin to new heights, encourage institutional investment, and enhance the overall legitimacy of cryptocurrencies.

Disclaimer: The above article is for informational purposes only and does not constitute financial advice. The cryptocurrency market is volatile and unpredictable; always conduct your research before investing.